If you are someone who is just getting started with investing or managing your business finances, you have probably heard of terms like ROE and ROCE. They might sound like complicated finance jargon at first, but don’t worry – they are actually quite simple to understand. In this blog, I will break down ROE and ROCE in easy words and explain why they matter for your investment or business decisions.

What is ROE (Return on Equity)?

ROE tells you how much profit a company makes with the money that shareholders have invested. In other words, it’s a measure of how well the company is using your money to make more money.

ROE Formula:–

ROE = Net Profit / Shareholders’ Equity

Let’s say a company earns ₹10 crore in net profit, and the shareholders have invested ₹50 crore. The ROE would be:

ROE = 10 / 50 = 0.20 or 20%

This means the company is generating a 20% return on the money shareholders have put in. That is a pretty decent return.

Why is ROE important?

ROE is important because it shows how efficiently a company uses its equity base to grow profits. A high ROE usually means the company is financially healthy and is managing its resources well. But here is the thing: ROE should not be looked at alone. It can be high because of high debt too, and that’s where ROCE comes in.

What is ROCE (Return on Capital Employed)?

Now let’s talk about ROCE, or Return on Capital Employed.

ROCE measures how well a company is using all its capital – not just equity, but also the debt it has borrowed. It gives you a bigger picture of the company’s efficiency.

ROCE Formula:-

ROCE = EBIT / Capital Employed

EBIT stands for Earnings Before Interest and Taxes.

Capital Employed = Total Assets – Current Liabilities ( Debt + Equity)

If a company has ₹15 crore EBIT and has ₹100 crore in capital employed:

ROCE = 15 / 100 = 0.15 or 15%

So, the company is generating a 15% return on the total money it has, including both debt and equity.

Why is ROCE important?

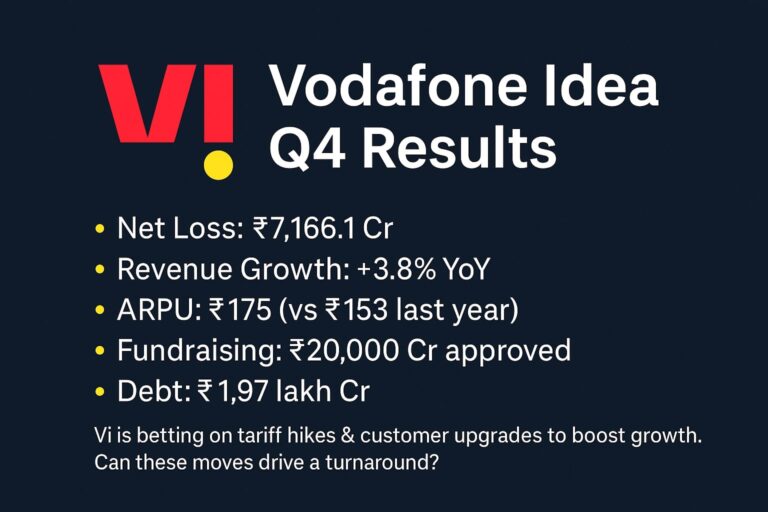

ROCE is especially useful when you want to know how well a company is using all the funds it has at its disposal – not just what shareholders invested, but also the loans it has taken. It’s great for comparing companies in capital-intensive industries like manufacturing, telecom, or utilities

ROE vs ROCE: What’s the Difference?

| Aspect | ROE (Return on Equity) | ROCE (Return on Capital Employed) |

|---|---|---|

| Measures | Return on equity invested by shareholders | Return on total capital (debt + equity) |

| Focus | Profitability for shareholders | Overall efficiency of capital usage |

| Useful for | Equity investors | Business analysis & capital-heavy sectors |

| Influenced by Debt | Yes | Less sensitive to debt |

A company with high ROE but low ROCE might be taking on too much debt. That is a red flag for investors. So, looking at both ROE and ROCE gives you a clearer picture of how the company is actually performing.

What is a Good ROE and ROCE?

This depends on the industry, but as a general rule:

- ROE above 15% is considered good.

- ROCE above 12% is a healthy sign.

The key is to compare these ratios with other companies in the same industry and track how they are changing over time.

Real Life Example: Infosys vs TCS

Let’s compare two famous Indian IT giants – Infosys and TCS.

In FY24, TCS had an ROE of about 40%, while Infosys had around 32%.

Their ROCE was also strong, around 36% for TCS and 28% for Infosys.

What does this tell us?

Both companies are highly efficient, but TCS is using its capital and equity slightly better than Infosys. As an investor, this kind of information helps you make smarter choices.

How to Use ROE and ROCE for Investing

- Compare with industry peers: Don’t look at one company in isolation. Compare ROE and ROCE with other companies in the same sector.

- Watch for debt: A company may boost ROE by taking on more debt. ROCE helps balance that view

- Track over time: A consistent or improving ROE/ROCE is a good sign.

- Check profit margins: A company with high ROE and good profit margins is usually efficient.

Limitations of ROE and ROCE

While both are powerful tools, they have limitations:

- ROE can be misleading if a company has high debt.

- ROCE doesn’t account for tax or interest payments.

- Both can be distorted by accounting tricks or one time earnings.

So, use them along with other tools like Debt-to-Equity ratio, Profit Margins, and Free Cash Flow for a complete analysis

Conclusion

You don’t need to be a finance expert to understand ROE and ROCE. They are just smart ways to check if a company is making good use of the money it has, whether it is from shareholders or lenders. For investors, these ratios offer a quick look into how well your money could grow. For business owners, they help you understand if you are managing your capital efficiently. Think of ROE as how well you are using your own money, and ROCE as how well you are using all the money available to you.

Reference:-